The price of Bitcoin has been quite bubbly over this weekend, surpassing the $85,000 mark on Saturday, April 19. This positive single-day performance caps off what has been a relatively stable past seven days of price action for the premier cryptocurrency.

However, the price of BTC is still far beneath the cycle highs, with the market leader currently more than 21% away from its all-time high. With the Bitcoin price stuck in a broader consolidation range, investors appear to be losing patience with the world’s largest cryptocurrency.

Are Bitcoin Investors Selling Again?

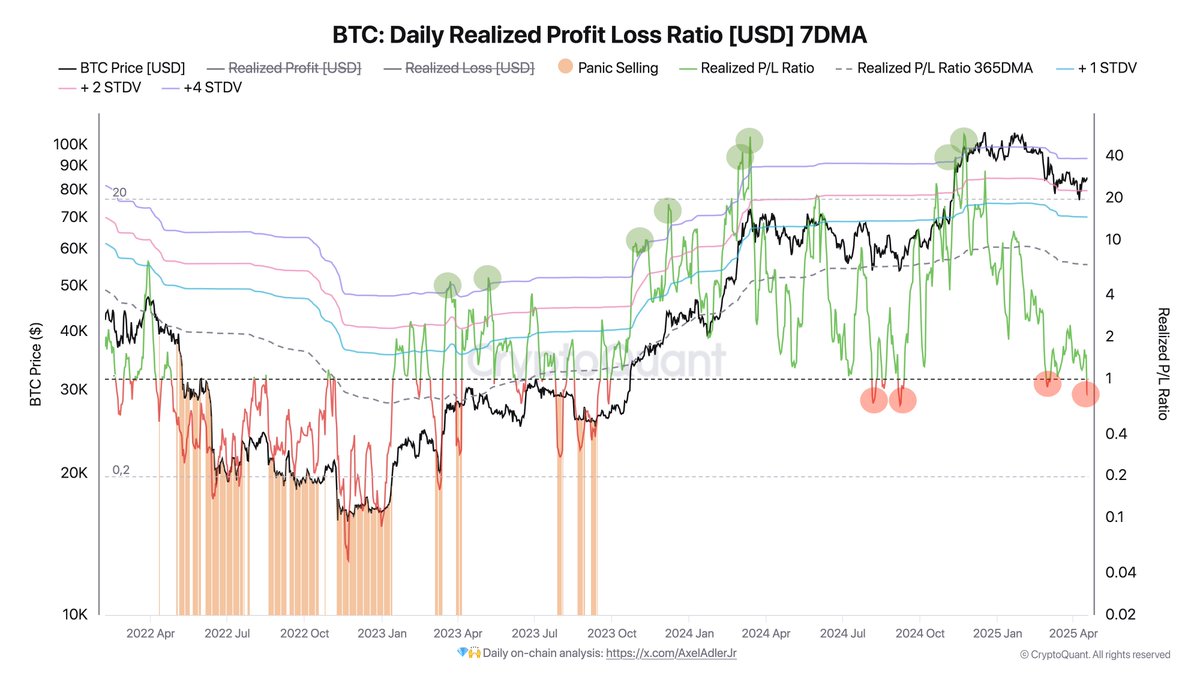

In their latest post on the X platform, on-chain analyst with the pseudonym Darkfost revealed that several BTC investors have resumed offloading their assets at a loss. The relevant indicator here is the Bitcoin Daily Realized Profit Loss Ratio, which estimates whether more investors are selling at a profit or a loss.

This profit/loss ratio is calculated by dividing the total realized profits by the total realized losses over a specific period. When the metric is above 1, it means that more investors are selling in a profit than at a loss. Meanwhile, a less-than-one value for the indicator suggests that more investors are cutting their losses.

Source: @Darkfost_Coc on X

As shown in the chart above, the Bitcoin Daily Realized Profit Loss Ratio has been above 1 for several past weeks. However, the metric recently fell — for the second time in 2025 — beneath the key threshold, signaling that the majority of investors are realizing their losses.

According to Darkfost, the current level of the indicator is yet to indicate full-scale market capitulation, but rather a phase of uncertainty and potentially accumulation. The on-chain analyst also mentioned that the metric’s current layout is similar to the structure seen in late 2024.

Darkfost, however, noted that this doesn’t necessarily mean that the premier cryptocurrency will witness the same outcome from this situation. When the Bitcoin Daily Realized Profit Loss Ratio fell to this level in 2024, the BTC price embarked on a price rally above the $100,000 level.

Darkfost added:

We can also observe that whenever the ratio reached the +4 STDV deviation from the 365DMA, a local market top consistently formed, followed by a short-term correction during bull phase.

The on-chain analyst concluded that, given the high level of uncertainty in the crypto market in recent weeks, the more likely outcome from this situation is a capitulation phase, where realized losses will continue to climb.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $85,300, reflecting a 0.8% increase in the past 24 hours.

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.