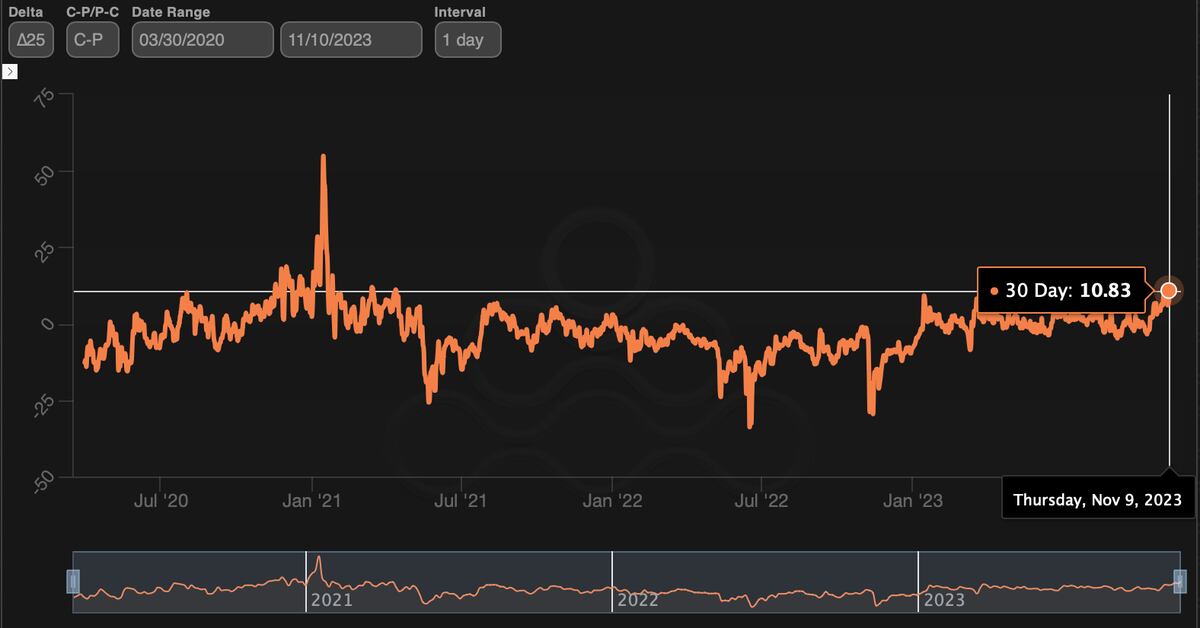

Bitcoin’s 25-delta one-month call-put skew, which assesses the relative price of calls versus puts expiring in four weeks, has risen above 10%, reaching the highest since April 2021, according to data tracked by Amberdata. In other words, demand for calls or bullish bets is outpacing puts, offering downside protection.