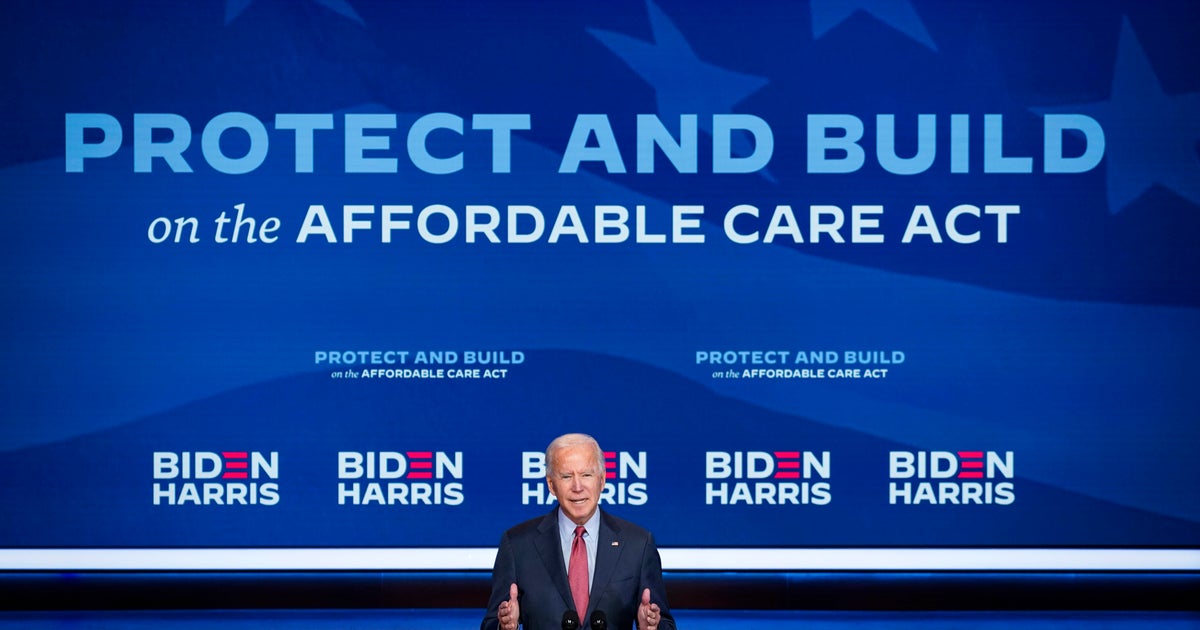

Brian Armstrong, chief executive officer of Coinbase Global Inc., speaks during the Messari Mainnet summit in New York, on Thursday, Sept. 21, 2023.

Michael Nagle | Bloomberg | Getty Images

Now that the SEC has approved the creation of bitcoin exchange-traded funds, Coinbase’s position in the crypto market is poised to take a dramatic turn.

In the weeks ahead, Coinbase will help shepherd some of the biggest names in asset management, including BlackRock, Franklin Templeton, and WisdomTree, into the digital asset ecosystem as their custodial partner of choice. That means Coinbase will be central to the storage and safekeeping of the assets for those firms.

While custody revenue presents a big growth opportunity for Coinbase in the near term, some industry analysts are concerned that the company’s core transaction business is at risk due to the myriad ways investors will be able to access bitcoin. Instead of having to go to an asset exchange such as Kraken, Binance, or Coinbase, they’ll be able to invest in the digital currency through the same mechanism they already use to buy stock and bond ETFs.

In a report Dec. 4, analysts at Bernstein predicted that in less than five years, 10% of the global supply of the world’s largest cryptocurrency, or roughly $300 billion, will be managed by ETFs. The firm called it the “largest pipe ever built between traditional financial markets and crypto financial markets.”

In 2023, Coinbase’s stock was one of the top performers in the tech industry, soaring almost 400%. Much of that rally was tied to bitcoin, which increased 150%. But part of the outperformance relative to bitcoin was due to the excitement that new ETFs would drive more interest in crypto and be a boon for Coinbase.

“ETFs should expand the pie and bring new people and institutions into the cryptoeconomy,” Coinbase Chief Operating Officer Emilie Choi said on the company’s most recent earnings call in November. “They should add credibility to the market, and we should see increased liquidity and market stability as we’ve seen with other asset classes such as gold.”

From June 15, the day that BlackRock — with its $9 trillion in assets under management — filed for a so-called spot bitcoin ETF and named Coinbase its crypto custodian, shares in the exchange rose from around $54 to over $170 by the end of the year.

JPMorgan analysts wrote in a November report that Coinbase would be a key beneficiary of the coming ETF boom, given the immediate upside of custody fees from asset managers.

“We estimate Bitcoin custody and surveillance revenue will more than offset decline in Bitcoin trading volume as assets migrate to ETFs,” the analysts said.

Some of the momentum on Wall Street has faded to start 2024, with the stock down 14% since the calendar turned. According to Mizuho analysts, there could be more pain to come.

“With the hype around Bitcoin ETFs likely to reach a climax in the coming weeks, COIN bulls could experience a rough awakening when they realize how minimal the revenue impact is,” Mizuho wrote in a note Thursday.

Mizuho’s analysts have the equivalent of a sell rating on the stock and were bearish throughout last year’s rally, finishing 2023 with a $54 price target, by far the lowest among analysts tracked by FactSet.

The battle for market share

Almost half of Coinbase’s revenue comes from the fees it charges on transactions, meaning the company needs people to keep using the exchange to buy and trade bitcoin and other digital currencies.

In the third quarter in 2023, total transaction revenue accounted for 46% of net revenue. However, Coinbase has been diversifying into new businesses. In 2022, transactions made up closer to 75% of revenue.

More than one-quarter of Coinbase’s revenue in the third quarter came from interest income on the exchange’s stablecoin reserves, including Circle’s U.S. dollar-pegged USDC coin. Stablecoin revenue more than doubled from a year earlier primarily due to rising interest rates.

“A few years ago, our business at Coinbase was 95% trading fees, and we made a big effort around the time it went public to start diversifying our revenue,” CEO Brian Armstrong told CNBC in a recent interview. “What’s great is that now we have multiple sources of revenue — some of them in a high interest rate environment go up, some of them in a low interest rate environment go up.”

Still, transaction fees remain a key income driver for the exchange. And unlike trading platform Robinhood, which enables investments in a wide array of asset types, Coinbase doesn’t allow for trading of ETFs.

“Spot bitcoin ETFs appear poised to take volume away from crypto exchanges,” said Bryan Armour, director of passive strategies research for North America at Morningstar.

JPMorgan anticipates that new account growth will slow as “novice crypto investors get their initial exposure and possibly final exposure through ETFs rather than Coinbase,” adding that many of these neophyte traders will never go beyond bitcoin, “thus never needing the services of a Coinbase.”

Mizuho sees the income from custody fees as fairly modest given how far investors have pushed up the stock. The firm predicts ETF approval may add just $25 million to $30 million in annual custody fees, with another $200 million to $210 million of new revenue “if incremental Bitcoin inflows generate additional spot trading opportunities.”

With a collective gain of up to $240 million in additional annual revenue, “this represents just mid-to-high single-digit percentage upside vs. current 2024 consensus,” the Mizuho analysts wrote. They said they “do not believe the nearly 400% increase in the stock in anticipation of ETF approval justifies our reasonable estimate for the ETFs’ actual contribution to revenue.”

A Coinbase spokesperson told CNBC in an emailed statement that, in addition to custody fees, the company will make money by providing services such as agency trading, matching and settlement, and financing to ETF issuers.

“The platform believes that spot ETFs will be a positive catalyst for the entire crypto space, adding credibility, increasing liquidity, and bringing new participants and institutions into the cryptoeconomy,” the spokesperson said, reiterating prior comments from Coinbase executives.

Competition could also create pricing pressure.

ARK, Invesco, Fidelity, WisdomTree, and Valkyrie are all offering deals that involve fee-free trading for a certain period of time. Others are opting for discounted fees.

Coinbase’s transaction fee varies, with a max of 0.6% on transactions up to $10,000 in value. In the company’s most recent quarterly earnings call, Choi said that Coinbase doesn’t plan to reduce transaction fees to make them more competitive with other platforms where ETFs are being traded at significantly lower prices.

The transaction charges on Coinbase also vary between its Pro platform and the retail app, where fees are higher. For retail transactions up to $1,000, the fee ranges from 1.5% to 3%.

However, JPMorgan analysts said greater efficiency and transparency in equity markets, paired with lower costs to execute, could drive more cryptocurrency trading to ETFs over time, which could ultimately “pressure Coinbase to lower commissions and to narrow trading spreads, reversing the multi-quarter increase we’ve witnessed in Coinbase’s retail revenue capture.”

Still, Coinbase has its believers among crypto enthusiasts, such as Nic Carter, a partner at Castle Island Ventures.

“They are essential infrastructure in terms of custody, trading, and surveillance for the majority of the ETF proposals,” Carter said. “Even though it might affect their fees at the margin I think they are still winners here.”

WATCH: Former SEC Chair Jay Clayton on changes in bitcoin trading